Below we explain how you can calculate the taxes or fare amount of a journey in bookings with more than 1 journey.

To calculate the taxes

In GDS there are different ways to calculate the taxes of a journey and we’ll now explain some of them.

Using the command FQP

Using FQP simulates a quote, whereby we see the taxes applied to the OW of which we would like to know the amount.

Taxes information by country of issue

GDS have a tax information pages. To see the details of all applicable taxes by country, you can use the following commands:

The blue text is the country code.

See price of a single journey

To see a single leg in a booking with more journeys, you must first access the ticket details using the command:

- In Euros (for domestic routes)

By displaying the ticket you can verify the price of the booking fare by legs.

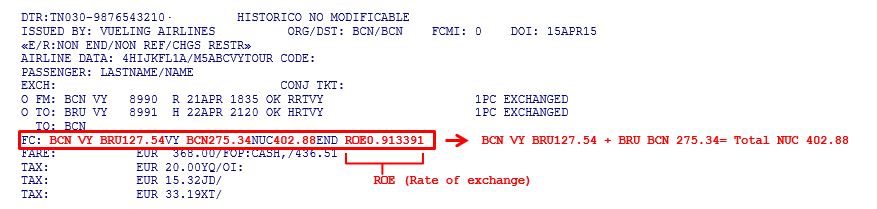

- In NUC (for international routes)

In tickets where the price appears in NUC, which is the fictitious currency created by IATA for international fares, you must perform the calculation as follows:

To see the price in the currency of the country where the ticket is issued, you must multiply the price of the leg to be refunded in NUC x ROE (Rate of Exchange).

In GDS you can also calculate with the following commands, always indicating the ticket issue date so that the correct conversion is applied.